IMPACT OF MACROECONOMICS VARIABLES ON FIRMS’ PERFORMANCE IN NIGERIA

INTRODUCTION

Background of the Study

Every company operates within the internal and external environments of business. The internal environments are within a firm such that the prevailing factors are most times very subject to the control of the managers. The external environment has to do with the larger business environments in which a firm operates; the factors therein are not subject to the control of the managers.

The factors in the external environment not subject to the control of a manager generally can be regarded as macroeconomic factors or variables. The corporate managers cannot control the macroeconomic variables but the government can control them through several policies.

Thus, like all experts, the government in order to do a good job of managing the economy will have to study, analyze and understand the major variables that affect or determine the current behavior of the macro-economy. Examples of the macro-economic variables that affect the economy and firms majorly include exchange rate, foreign direct investment, inflation rate, interest rate, money supply, etc… (Scroll down for the link to get the Complete Chapter One to Five Project Material)

Statement of Research Problem

Researches on the relationship between macroeconomic variables and firms’ performance have been ongoing in advanced countries of the world with little or no research in developing countries of the world such as Nigeria. It is this existing gap that informed the rationale behind this study. In light of the above, the following research questions are raised:

a. What is the effect of the inflation rate on corporate performance in Nigeria? (Scroll down for the link to get the Complete Chapter One to Five Project Material)

Research Objectives

The general objective of the study is to evaluate the impact of macroeconomic variables on corporate performance in Nigeria. However, the specific objectives are stated as follows:

· To ascertain the effect of the inflation rate on corporate performance in Nigeria.

· To find out if there is a significant relationship between exchange rate and corporate performance… (Scroll down for the link to get the Complete Chapter One to Five Project Material)

LITERATURE REVIEW

Introduction

This second chapter consists of literature to be reviewed which is pertinent to macroeconomic variables and their role in the performance of corporate bond markets. It discusses the empirical review, theoretic review, summary of the reviewed literature, conceptual structure, and the study gaps it sought after to satisfy.

Theoretical Literature Review

Theories guiding the study are as follows:

- Efficient Market Hypothesis Theory

Fama (1970) postulated efficient market hypothesis (EMH) theory which describes behaviors of a perfect market in which securities are held at the equilibrium and prices of securities (stock and bonds) are displayed as public information that can be accessed and acted upon immediately this has been announced.

This is so because; securities that are priced fully and fairly call for quick action by the investors. In simple terms, the idea is to have a market whose price is a reflection of accurate indicators for the apportionment of funds.

This suggests that a marketplace in where corporations know how to craft venture choices on production is capable to choose investments that reflect tenure of firm undertakings with the supposition that security prices will show the available facts. It stipulates that an efficient market is a marketplace where prices portray all available data… (Scroll down for the link to get the Complete Chapter One to Five Project Material)

- Trade-off Theory

Modigliani and Miller (1963) note that trade-off theory maintains the firm’s optimal ratio of debt is measured by a trade-off among the outlays involved and the paybacks derived from acquiring debts, this holds the firm’s properties and asset plans constantly. Static trade-off theory opines that organizations that have large tangible assets have a greater liability to equity proportion.

Firms that depend solely on opportunities for growth intangible assets might be exposed to distress cost. Firms that are exposed to business risks are uncertain about generating adequate income to optimize their debt tax shield and thus issue less debt… (Scroll down for the link to get the Complete Chapter One to Five Project Material)

Empirical Review

The review of literature empirically as guided by the study objectives is arranged as follows:

- Inflation Rate and Performance of Corporate performance

There is a growing rift of the findings of empirical literature in the developing and the developing world in respect to the encouragement of micro-economic variables on the performance of security exchanges.

According to Garcia and Liu (1999), they tested the level of volatility among macro-economic factors and how this bears on the performance of the securities market, alternatively Maku and Atanda (2010) exposed the functionality of the securities market in Nigeria was impacted by macroeconomic dynamics in the long run… (Scroll down for the link to get the Complete Chapter One to Five Project Material)

- Interest Rate and Performance of Corporate performance

Henry, Olekalns, and Suardi (2005) did a study on equal influences and equity return volatility and uneven changing aspects of interest rate in the short-term in Australia. The focal aim of research remained to examine association amid equity yields and interest rates in the short-term.

Data from the results endorse that that interest rate in the short- term unpredictability summits with the rate of short-term rates of interest, whereas instability of equity retorts irregularly to negative and positive shocks. Kim and Stock (2011) concentrated on the impact rate of interest instability on business income ranges on both callable and non-callable bonds.

Their analysis said a supposition if higher interest rate instability escalates an organization’s liability instability, its business more aptly attains a serious risk aimed at defaulting, therefore causing a more return spread. They discovered that there is a positive association of interest rate volatility with yield spreads on non-callable bonds… (Scroll down for the link to get the Complete Chapter One to Five Project Material)

- Exchange Rate and Performance of Corporate performance

The exchange rate in many countries is one of the critical price aspects in the state of the economy since it regulates internationally the balance of payments (Levich, 2001). Investors opt for investment where the rate of exchange is unstable since the risks are minimal (exchange rate risk).

Bradley and Moles (2002) defined the rate of exchange as the unit of the price of the domestic to foreign currency compared. Mbugua (2003) found a rate of exchange negatively altered the progress of the market for a corporate bond. Murthy and Sree (2003) argued that the exchange rate enables a comparison of prices of commodities quoted in diverse currencies… (Scroll down for the link to get the Complete Chapter One to Five Project Material)

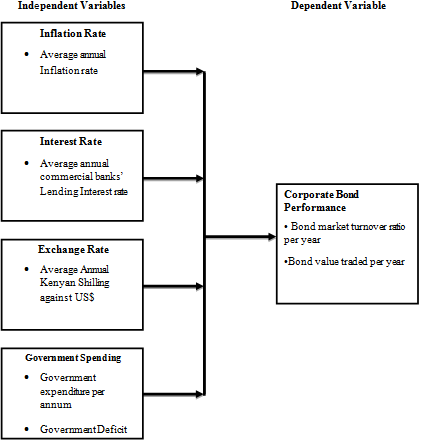

Conceptual Framework

Figure 2.1 Conceptual Model Source: Author (2018)

RESEARCH METHODOLOGY

The chapter presents a detailed account of the methodology that the researcher utilized within the study. It comprises adopted research design, the targeted population of the study, sampling procedure, and sample size and procedures and methods applied in gathering the data that was made use of in the study. It also presents the testing of reliability and validity of data, the empirical model utilized, and the presentation of the findings. Lastly, the chapter provides the ethical considerations that the researcher factored.

Research Design

The research adopted was Quantitative research design. It is usually planned towards offering additional understanding into the study problem by relating the variables under investigation (Mugenda and Mugenda, 2003). According to Bryman and Bell (2007), there are two principal categories of quantitative research: longitudinal surveys and cross-sectional surveys… (Scroll down for the link to get the Complete Chapter One to Five Project Material)

Target Population

The population target was derived from all corporate performance traded at the N.S.E within a period of fifteen-year from January 2001 to December 2015. Records maintained at the NSE indicate that a total of 16 treasury bonds were consistently traded over the fifteen-year period.

The fifteen-year period was considered enough to monitor the trend for corporate performance against macroeconomic variables. The entire population (census) was used for the study… (Scroll down for the link to get the Complete Chapter One to Five Project Material)

RESEARCH FINDINGS AND DISCUSSION

Introduction

This chapter gives a discussion of the analysis of data, the interpretation also findings which have been done as per with the objective of this study which was to explore the effects of macro-economic variables on how corporate bond performs at Nigerian N.S.E. The analysis includes diagnostic tests, correlation, and regression analysis also descriptive figures.

Diagnostic Tests

The study conducted multicollinearity tests these included variance inflation factor and heteroscedasticity to find out if the assumptions of the linear model were met.

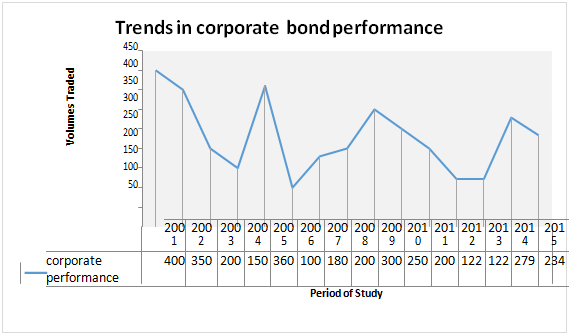

Performance of Corporate performance

The study strived to ascertain how corporate performance performed over the study period and compare the trend with that of the macro-economic elements so as to draw valuable lessons on the impacts of the macro-economic elements and performance of corporate performance.

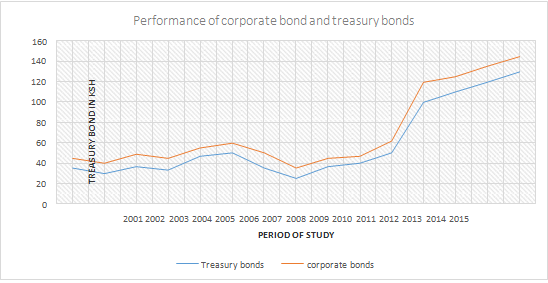

It was noteworthy that the how corporate performance performed at NSE was as well tumultuous over years for reasons that are not very clear cut in the Nigerian context, but the role of macro-economic variables will be delineated by this study. Figure 4.1 gives the movement in the performance of corporate performance issued at bourse of duration the study wishes to examine.

Figure 4.1 Trend in Performance of Corporate performance

Source: Study data (2018)

The performance of the corporate performance as indicated by volumes traded was in conformity with the trend of most of the macro-economic variables especially economic growth, though not part of the study variable, to a great extent than other variables under consideration.

The pattern of corporate performance at NSE is very noticeable and well established. At one point in 2007, the rate of growth was negative showing that the economy had actually declined during that period.

Figure 4.2 Comparing Corporate Corporate performance to Treasury Bonds

Outcomes in figure 4.2 above indicate the treasury bonds value always surpassed that of treasury bonds for all the considered years. It should be noted that ordinarily, treasury bonds outperform corporate performance but, in the data, provided the figures for corporate performance were higher because of the inclusion of both local and foreign bonds… (Scroll down for the link to get the Complete Chapter One to Five Project Material)

SUMMARY, CONCLUSIONS, AND RECOMMENDATIONS

Summary

Research pursued the aim of determining the influence of macro-economic variables that is the inflation rate, exchange rate, interest rate, and government expenditure on the performance of corporate performance at the Nigeria Securities Exchange, Nigeria for the period between 2001 and 2015.

During the review period, the corporate performance represented only a small slice of the total bond market. Findings from the regression analysis depict greater than half of the disparity in the performance of corporate performance is influenced by variants in macro-economic variables that is; interest rate, exchange rate, government expenditure, and inflation.

· Inflation rate and performance of corporate performance at the N.S.E

The study established highly unpredictable inflationary trends in the economy with the highest annual inflation rate during the period being more than eight times the least annual inflation rate reported in the review period.

The results of Regression analysis demonstrated the inflation rate as a valuable predictor of how corporate performance performed. Pearson correlation analysis output further indicated that the inflation rate had a robust, negative also significant statistical association with how corporate performance performed… (Scroll down for the link to get the Complete Chapter One to Five Project Material)

Conclusion

The subsequent conclusions were made based on study findings. First, the study was informed by the coefficient of determination that the macroeconomic variables assessed formed a good model in predicting the performance of corporate performance at the Nigerian bourse market. On inflation, the study resolved that inflationary conditions and trends were highly unpredictable in the economy… (Scroll down for the link to get the Complete Chapter One to Five Project Material)

Recommendations

A commendation is put together to state and economic planners to move to control the macro-economic factors in the economy and especially inflation, rate of interest, and rate of exchange which would take deteriorating influence on how corporate performance performed.

There is a need for the government and its fiscal agents to regularly review the policy on monetary issues to keep the condition of inflation in the economy under check… (Scroll down for the link to get the Complete Chapter One to Five Project Material)

REFERENCES

Aburime, T.U. (2008). Determinants of bank profitability: Macroeconomics evidence from Nigeria. Lagos Journal of Banking, Finance and Economics Banking, 33(l), 16-41

Adelegan, J. O., & Radzewicz-Bak, B. (2009). What determines bond market development in sub-Saharan Africa. IMF working paper, WP/09/213.

Adetayo, J. O, Dionco- Adetayo, E. A, & Oladejo, K. A. (2004) Management of Foreign risks in selected commercial banks in Nigeria.

Arestis, P., Demetriades, P. O., & Luintel, K. B. (2001). Financial development and economic growth: The role of stock markets. Journal of Money, Credit, and Banking, 33(1), 16-41

Azarmi, T., Lazar, D., & Jeyapaul J. (2005). Is the Indian Stock Market a Casino. Journal of Business and Economic Research, 3(4), 39 – 46.

Backberg, S. (2014). On compensation for illiquidity in asset pricing: An empirical evaluation using three factor model and three-moment CAPM. Working paper, Florida International University.

Baraza, C. (2014). Macro-economic determinants of stock market performance in Nigeria. Unpublished thesis, University of Nigeria. (Macroeconomics Variables)(Macroeconomics Variables)

Barnes, P. (2009). Stock Market Efficiency. Insider dealings and Market Abuse, 1-28. Bergen, J.V. (2010) 6 Factors that influence exchange rates. Investopedia. (Macroeconomics Variables)(Macroeconomics Variables)

Bhattacharyay, B. N. (2013). Determinants of bond market development in Asia. Journal of Asian Economics, 2(4), 124-137. (Macroeconomics Variables)(Macroeconomics Variables)(Macroeconomics Variables)

Booth, T. L. (2011). A study of the underlying Impediments to issuance of Corporate performance through NSE. Unpublished MBA Project, University of Nigeria. (Macroeconomics Variables)(Macroeconomics Variables)

Bradley, K., & Moles, P. (2002). Managing Strategic Exchange rate exposure: Evidence from UK firms.

Buigut, K., Soi, N., Koskei, I., & Kibet, J. (2013). The effect of capital structure on share price on listed firms in Nigeria. A case of energy listed Firms. European Journal of Business and Management, 5(9), 100-122

Carmichael, J., & Pomerleano, M. (2002). The development and regulation of nonbank financial institutions (The World Bank, Washington, DC). Central Bank of Nigeria, 2013.

Chen, L.W. (2004). Is the Rate of Stock Returns a Leading Indicator of Output Growth? A case of four East Asian Countries. (Macroeconomics Variables)(Macroeconomics Variables)(Macroeconomics Variables)(Macroeconomics Variables)

Chordia, T., Roll, R., & Subrahmanyam A. (2000). “Commonality in Liquidity”, Journal of Financial Economics, 56, 3-28.(Macroeconomics Variables)(Macroeconomics Variables)(Macroeconomics Variables)(Macroeconomics Variables)(Macroeconomics Variables)(Macroeconomics Variables)

Cooper, D. R., & Schindler, P.S. (2005). Business research methods, 8th edition, Mc Graw-Hill, New Delhi, India.

Davis, E.P. (2001). Multiple avenues of intermediation, corporate finance, and financial stability. IMF Working Paper, 01/115. (Macroeconomics Variables)(Macroeconomics Variables)(Macroeconomics Variables)(Macroeconomics Variables)

Davis, E.P., & C. Ioannidis, (2002) Does the availability of bank borrowing and bond issuance smooth overall corporate financing. Working Paper, Brunel University. (Macroeconomics Variables)(Macroeconomics Variables)(Macroeconomics Variables)

(Scroll down for the link to get the Complete Chapter One to Five Project Material)