EFFICIENCY OF ACCOUNTING SOFTWARE IN THE PREPARATION OF FINANCIAL STATEMENTS

ABSTRACT

The study focuses on assessing the impact of the use of accounting software in preparing the financial statements of commercial banks in Nigeria. The center of attention was on three commercial banks namely GT bank, FCMB, and First Banks; all in the Benin City, Edo State. A stratified sampling technique was used to select this sample.

The Banks were stratified as follows: computerized and networked bank computerized but not networked and partially computerized. The main objective of this work is to explore how Accounting software has forever changed many aspects of business and accounting practices especially in preparing financial statements and to consider the main reasons for the reluctance of some Commercial banks to adopt and utilize this new capability.

The focus of the research was on areas that the researchers considered very critical in accounting software… (Scroll down for the link to get the Complete Chapter One to Five Project Material)

INTRODUCTION

Background of the Study

The increasing globalization of the world economy precipitated organizations the world over to compete in the global marketplace leading to the emergence of a new set of accounting challenges such as multiple currencies and follow a horde of accounting and tax rules. Thus, a more refined accounting software packages competent of managing international accounting intricate issues are increasingly in need (Adhikari, Lebow & Zhang, 2004). However, great technology advancement has rendered the options of using accounting information from a strategic point of view.

The adoption of Accounting Software becomes major aspect in determining the survival, growth, and success of an organization as firms require more information, be it monetary or non-monetary, to deal with a higher scale of uncertainties in the competitive market and require data processing capacity and system to ameliorate to suit their information needs (Van de Ven & Drazin, 1984) in this global economy era… (Scroll down for the link to get the Complete Chapter One to Five Project Material)

Statement of the Problem

Since the 1950s, when technology started to be applied in business (Otieno and Oima,2013), most developing countries in the world have abandoned the use of a pen and a paper and started to adapt to the use of accounting software to facilitate the generation of quality, quick and accurate financial reports… (Scroll down for the link to get the Complete Chapter One to Five Project Material)

Research Objectives

The following are the objectives of this study:

- To investigate the impact of accounting software on the bank payroll financial preparation and reporting in the banks… (Scroll down for the link to get the Complete Chapter One to Five Project Material)

LITERATURE REVIEW

The use of Accounting Information Systems (AIS) is a widely researched topic. While there is much research on the impact of Accounting Information Systems (AIS) in general; there is little research specifically on accounting software and its impact on financial reporting. Accounting software, however, is widely used in many corporate bodies including SMEs.

For example, in Australia, the Yellow Pages (1997) reported that 76% of the small businesses surveyed had at least one computer, and 75% of this used accounting software. Burgess (1997) in a review of IT adoption by Australian small businesses concluded that the main software application package used was accounting (Burgess 1997 and Wenzler 1996)… (Scroll down for the link to get the Complete Chapter One to Five Project Material)

Accounting

Accounting is not only the oldest but also the most stable of the management disciplines. In spite of its stability and continuity, accounting has seen major changes during the past century. It would be surprising if a century from now, accounting is the same as today. Although we cannot look so far ahead, we can analyze the current conditions for clues about what to expect in the next decade or two (Sunder 1999). Accounting provides financial information about a business or a not-for-profit organization… (Scroll down for the link to get the Complete Chapter One to Five Project Material)

Accounting Systems

Every company applies to account because it is generally accepted that companies have to reveal certain financial and management information to economic users and of course because accounting is an indispensable tool in the business decision-making process. Accounting is an important part of every company thus; businesses are required to keep proper books of accounts (Section 123 of the Companies Code (1963), Act 179). “Accounting can be divided into two basic categories: those which apply manual accounting and those which prefer accounting software” (Weber, 2010).

Manual Accounting System and its Shortcomings

Briefly, a system is a set of interdependent elements that together accomplish specific objectives. The manual accounting system is an information system and Romney & Steinbart (2009) defined an information system as an organized means of collecting, entering, and processing data and storing, managing, controlling, and reporting information so that an organization can achieve its objectives and goals. Tanis and Dalci (2002) emphasized that the information system has the following components; Goals and objectives, Inputs… (Scroll down for the link to get the Complete Chapter One to Five Project Material)

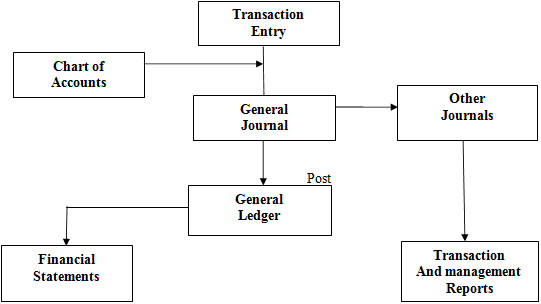

Figure 2.1 A Manual Accounting System Model

At first look, it is not very difficult and it is so indeed, but when there are thousands or millions of transactions the situation dramatically changes. Lots of transactions that must be processed in the accounting… (Scroll down for the link to get the Complete Chapter One to Five Project Material)

IMPORTANCE OF ACCOUNTING SOFTWARE

accounting software is important to businesses in various ways. The use of computers is time-saving for businesses and all financial information for the business is well organized (Baren, 2010).

- Time and Cost Savings

Using accounting software saves companies time and money. The use of a computer makes inputting accounting information simple. Transactions are entered into the system and the system processes and posts transactions accordingly. Accounting software reduces staff time preparing accounts and reduces audit expenses as records are neat, up-to-date, and accurate. Better use is made of resources and time; cash flow should improve through better debt collection and inventory control. More importantly, the system helps present financial reports on time to aid in the economic decision-making process of external users.

- Organization and Accuracy

Accounting software enables businesses to stay organized. When information is entered into the system, it makes finding the information easy. Employees can look up any financial information whenever it is needed. There is less room for errors as only one accounting entry is needed for each transaction rather than two (or three) for a manual system. The accounting records are automatically updated and so account balances (e.g. customer accounts) will always be up-to-date… (Scroll down for the link to get the Complete Chapter One to Five Project Material)

- Commercial Banking in Nigeria

Nair and Fisshab (2010) researched innovations in rural and agriculture finance in rural and community banks in Nigeria and found out that in Nigeria, commercial banks are the largest providers of formal financial services in rural areas. It was revealed that by the end of 2008, Nigeria had 127 Commercial banks with a total of 584 service outlets, representing about half of the total banking outlets in the country.

Facts also have shown that, before the late 1970s, rural dwellers in Nigeria had almost no access to institutional credit for farm and nonfarm activities, and in many rural communities, secure, safe… (Scroll down for the link to get the Complete Chapter One to Five Project Material)

RESEARCH METHODOLOGY

The Research Design

The research strategy adopted by the researchers is the multiple case study approach. The reason for this choice is to increase the reliability of the report as findings of the companies will be compared to find out the extent to which they follow a regular pattern.

Population

This study focused on 25 registered Commercial banks in Benin City, Edo State.

Sample and Sampling Technique

A stratified sampling technique was used to select this sample. The Banks were stratified as follows: computerized and networked bank, computerized but not networked, and partially computerized… (Scroll down for the link to get the Complete Chapter One to Five Project Material)

RESEARCH RESULTS AND DISCUSSIONS

The Need for Accounting Software

Of the three banks selected, two have already adopted Accounting software, First Bank and FCMB. However, GTBank is still in its adoption process. The two banks adopted Accounting software for several reasons including the under-discussed.

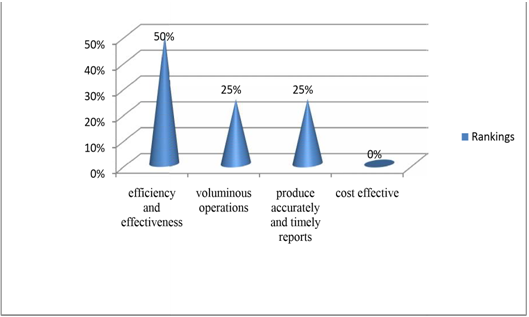

Increase in Efficiency and Effectiveness

At the turn of the millennium, the financial sector in particular, and the business environment in general, has become very competitive. In their quest to achieve the organizational goal of maximizing shareholders’ wealth through better customer service, the two banks adopted Accounting software suitable for their operations. They are of the belief that Accounting software help produces quality information that helps in the efficient and effective performance of their operations… (Scroll down for the link to get the Complete Chapter One to Five Project Material)

Operations of the company were voluminous

One of the main authorized businesses of a bank is to receive money (deposits) from the public and as well as lend or advance money as loans to the public. Banks, therefore, encounter a whole lot of people who are either coming in to make deposits or borrow. This, therefore, leads to a large number of transactions within which to process and also a huge database that must be maintained… (Scroll down for the link to get the Complete Chapter One to Five Project Material)

Source: Field Survey, May 2012

It must, however, be emphasized that the major factor considered by the banks before adopting their systems is to a large extent in line with what Waterfield et al (1998) said in their work that the use of computers in business is to ensure that all business and financial information is well organized effectively and efficiently.

It is however contradictory with Raymond and Bergeron (1992) who argued that businesses implement accounting software because of the advent of low-cost microcomputers among other reasons… (Scroll down for the link to get the Complete Chapter One to Five Project Material)

SUMMARY, CONCLUSIONS, AND RECOMMENDATIONS

Summary

The research was organized to assess the impact of the use of Accounting software in the financial reporting of commercial banks in Nigeria. The study also had another objective of bringing out the problems encountered in the use of Accounting software. Advancement in technology is now the order of the day. Businesses are constantly looking for cost-effective, economic, and efficient ways of satisfying customers’ needs.

Thus, there is a need for businesses to be abreast of the current issues in technology to enhance their business. This is to help gain a competitive advantage over their competitors especially in this era where there are more banks springing up… (Scroll down for the link to get the Complete Chapter One to Five Project Material)

Conclusion

The study revealed that because of the numerous benefits that are associated with accounting software, more importantly, its ability to produce and present relevant and faithful representative financial reports to end-users, the government of Nigeria is assisting all Commercial banks to migrate onto common accounting software known as Terminus 24 through the Millennium Development Account.

This is going to serve as a platform in which all the commercial banks in the country are going to be networked to each other to facilitate faster and efficient banking… (Scroll down for the link to get the Complete Chapter One to Five Project Material)

Recommendations

Based on the empirical findings of the study, the following recommendations are offered to commercial banks in particular, and the players in the banking industry.

- The government, through ARB Apex Bank, should reinforce its computerization policy for commercial banks… (Scroll down for the link to get the Complete Chapter One to Five Project Material)

REFERENCES

ABS (Australian Bureau of Statistics), (2000), Catalogue 8129.0 Business Use of Information Technology, Australia. Commonwealth of Australia

Baren, V., (2010), The Importance of an accounting software, available on http://www.ehow.com/facts_6786562_importance-computerized-accountingsystem.html#ixzz10yS7obSs; Accessed: 27/10/11

Beaver, William H. (1978) “Current Trends in Corporate Disclosure”, Journal of Accountancy, V.147: http://www.capitalideasonline.com/articles/index.php?id=2224

Burgess, S., 1998, Information Technology in Small Business in Australia: A summary of

Recent Studies, Paper presented to the USASBE Conference, Florida; January 15-18. [Available online on http://www.sbaer.uca.edu/Research/1998/USASBE], Assessed on 20th October, 2011

Business dictionary (2011) http://www.businessdictionary.com/definition/capital allowance.html, accessed on 15th February 2011

deSaintis, J., A brief history of Accounting: From prehistoric to the Information Age. Available at http://ensign.ftlcomm.com/historyacc/researchpaperfin.htm (accessed 28 September, 2011)

Elliot, B & Elliot, J (2006): Financial Accounting and Reporting, 11th ed.: Pearson Education Limited, Harlow, England

Frenzel, C. W., (2006), Management of Information Technology

Gelinas, U., Sutton S., and Hunton, J., (2005) Acquiring, Developing and Implementing Accounting Information System, 6th Ed.: Thomson South-Western Education College, Cincinnati

Gorton, M., (1999): “Use of financial management techniques in the UK-based small and medium-sized enterprises: Empirical research findings”, Journal of financial management and analysis, Vol. 12 No. 1, pp 56-64

Grabski, S., and Marsh, J. (1994), “Integrating Accounting and Manufacturing Information Systems; an ABC and REA-based approach”, Journal of Information Systems: pp 61-80

Greuning, H., V. (2006): International Financial Reporting Standards; A practical guide, 4thed. The World Bank

Head, B., (2000), “Small Business Should Log On and Write Off,” Business Review Weekly, March 24th, 22(11).

Kimunya, A., Fishstein, P., and Gaul, N., (2000): Guide to computerising your accounting system: The Manager, Vol. 8, No. 4

Nair, A., and Fisshab, A., (2010), Commercial banking: The case of Rural and Community Banks in Nigeria, International Food Policy Research Institute and the World Bank; July, Focus 18 Briefs

Nash, J., Heagy, C., and Courtney, H (1999): The design, selection, and implementation of accounting information systems: Dame Publication Inc., Houston

McMahon, G., and Holmes, S., (1991), “Small Business Financial Management Practices in North America: A literature review”, Journal of Small Business Management, April, Vol. 29, No. 2, pp 19-30

Paton, A., (1922): Accounting Theory; with special reference to the corporate enterprise, Kessinger Publishing (2009)

Proudlock, M., Phelps, B., and Gamble, P., (1999), “IT Adoption Strategies: Best Practice Guidelines for Professional SMEs,” Journal of Small Business and Enterprise Development, 6(3), 240-252.

(Scroll down for the link to get the Complete Chapter One to Five Project Material)