THE IMPACT OF INTERNAL AUDIT EFFICIENCY ON THE FINANCIAL PERFORMANCE OF COMPANIES (A CASE STUDY OF JULIUS BERGER PLC)

ABSTRACT

Internal auditing is a vital aspect of all organizations for the efficient and effective management of resources, the addition of value and improvement of operations for them to realize their financial goals. The internal audit department is a neutral source of information for the smooth management of resources, thus stakeholders have a level of confidence in the financial reports of the firm which reflects the efficiency of the department.

The study employed a descriptive research design. The population was made up of all the Julius Berger Plc… (Scroll down for the link to get the Complete Chapter One to Five Project Material)

INTRODUCTION

Background of the Study

Internal audits constitute an independent appraisal function that reviews the internal control system of the organization established. Auditing ensures the effective, proper, and economic use of resources in an organization through the objective examination, evaluation, and reporting on the adequacy of internal control.

The effectiveness of the auditing functions lies in its independence; The independence in terms of organizational status and personal objectivity of the internal auditor facilitates the proper and effective performance of his duties.

It is therefore essential that the internal audit unit is appropriately staffed with people with the right qualification and given the training necessary. The internal auditor must constructively align its functions with the management policy and maintain a good working relationship and mutual understanding with management, external auditors, and other review and exercise due care in executing its function of planning, controlling, and recording of work.

The internal control system must be properly evaluated to ensure its adequacy and effectiveness. The evidence obtained in the audit function should constitute the auditor’s report which must be communicated to the management for appropriate action. It is also the auditor’s role to ensure that all recommendations and conclusions are monitored to determine that action has been taken on them… (Scroll down for the link to get the Complete Chapter One to Five Project Material)

Statement of the Problem

Internal audits constitute an independent appraisal function that reviews the internal control system of the organization established. Auditing ensures the effective, proper, and economic use of resources in the organization through the objective examination, evaluation, and reporting on the adequacy of internal control.

The effectiveness of the auditing functions lies in its independence; The independence in terms of organizational status and personal objectivity of the internal auditor facilitates the proper and effective performance of his duties and of enhancing the financial performance of the organization… (Scroll down for the link to get the Complete Chapter One to Five Project Material)

Research Objective

- To determine the impact of internal audit efficiency on the financial performance of companies

- To determine the impact of internal audit efficiency on the financial performance of Julius Berger Plc.

LITERATURE REVIEW

Introduction

Several theories will be reviewed and empirical evidence on the significance of internal audit efficiency to firm financial performance will be presented in this chapter.

Theoretical Perspectives

This study will make use of three main theories namely; agency theory, legitimacy theory, and stakeholder theory.

- Agency Theory

Agency theory is a contract under which a person (the agent) is employed by one or more individuals (principals) to conduct some services for them; consequently, any ensuing decisions for the firm are made by the agent. Jensen and Meckling (1976) state that agency theory highlights management behavior, agency cost, and the own order of the organization.

The management of the firm is charged with the responsibility of maximizing shareholders’ wealth. According to the authors, there is not a particular theory that signaled and explained the conflicting interest of individuals participating in business operations and has the same goals of maximizing firm returns.

Jensen & Meckling (1976) explained it as a relationship between principal and agent, which involves the delegation of duties of managing the business affairs with an intention to maximize returns… (Scroll down for the link to get the Complete Chapter One to Five Project Material)

- Stakeholder Theory

The theory assumes that moral values and business ethics are essential in managing an organization. Wheeler et al., (2003) explain that this theory came about as a combination of the organizational and sociological disciplines. The theorists believe that in organizations, managers possess a network of relationships that include suppliers, employees, lenders, and other business partners who have the company’s interests at heart.

They make key decisions to realize the objectives of the organization like resource allocation and control and the activities that impact the organization and in one way or the other on others also. Stakeholders have diverse interests in the organization, of either environmental or of an economic nature… (Scroll down for the link to get the Complete Chapter One to Five Project Material)

Empirical Literature Review

Maijoor and Vanstraelen (2006) did a comparative study to explore the issue of earnings administration in a European setting. They analyzed the impacts of national audit condition, audit firm efficiency (utilizing intermediary of audit firm size), and dependence on worldwide capital markets on income administration exercises. Utilizing information from firms in France, Germany, and the UK, they found that when it came to earnings administration activities differ from nation to nation.

Their examination discovered three critical discoveries. Firstly, stricter national audit conditions assume a critical part in obliging income administration exercises paying slight note to the extent of the audit firms between the three nations. Secondly, the impact of huge size audit firms on income administration exercises just exists in the UK because of a stricter speculator insurance condition yet not in France or Germany.

Thirdly, firms that depend on worldwide capital markets are related to a more elevated amount of collections, which suggests that NYSE listings do not dissuade income administration… (Scroll down for the link to get the Complete Chapter One to Five Project Material)

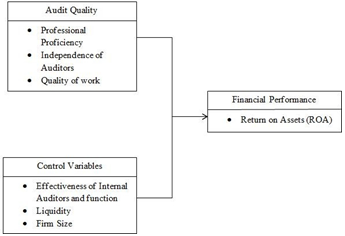

Conceptual Framework

The study’s conceptual framework will be composed of the independent and dependent variables. Financial performance will be the dependent variable and the independent variables are the audit committee size, auditors’ experience, auditors’ independence, and auditors’ qualification.

Figure 1: Conceptual Framework

(Scroll down for the link to get the Complete Chapter One to Five Project Material)

RESEARCH METHODOLOGY

Introduction

In this section, the researcher sought to respond to the various research questions so as to meet the goal and intent of the study. This section deals with research philosophy, research design, sampling, research instruments, data collection, and analytical methods. The research methodology is described as a way to comprehensively address the research problem, (Kothari, 2004).

Research Design

Research design is the ordering of conditions for gathering and data evaluation in a way that strives to put together pertinence to the research justification with a cost-cutting measure in the procedure (Kothari, 2008).

The research used here was a descriptive survey design. Information about a group of people (one or more), who are asked a number of questions with their answers being recorded and inputted into spreadsheet tables. The questions may be about their opinions, attitudes, characteristics, or experiences… (Scroll down for the link to get the Complete Chapter One to Five Project Material)

Population

Kombo and Tromp (2006) describe the population as a complete category of elements or persons that at the minimum have one thing that they share in common. Mugenda and Mugenda (2003) interpret it as a whole group of individuals, events, or objects that have a common noticeable attribute and adjust to a given description. A census of all companies was used since it is accurate and involves the whole population. The study population will be Julius Berger Plc, which are 66 listed companies.

Data Collection

There are several strategies for information gathering as stipulated by Ngechu (2004. Choosing an instrument or apparatus, for the most part, depends on the traits of the subjects; investigative theme, issue question, targets, outlines, and anticipated information and outcomes.

This is on the grounds that each device and instrument gather particular information. There are two major sources of data normally used and they are primary and secondary information sources… (Scroll down for the link to get the Complete Chapter One to Five Project Material)

RESEARCH FINDINGS AND DISCUSSION

Introduction

This chapter presents the various statistical approaches used to check the effect of internal audit efficiency on the financial performance of Julius Berger Plc. Data gathered from the field is shown and examined using descriptive and inferential statistics.

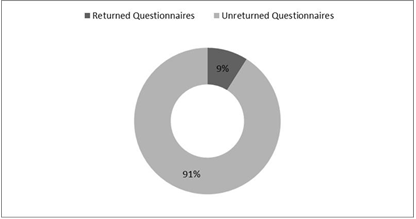

Response Rate

Figure 4.1: Response Rate

The study was done using the entire listing of firms listed in the NSE. Out of the 66 expected respondents, 60 were able to fill out and return the questionnaires; this led to a response rate of 91% to be achieved. The response rate was deemed to be adequate, since Sekaran, (2016) contends that any response above 75% is classified as optimal. Based on this, the response rate was excellent… (Scroll down for the link to get the Complete Chapter One to Five Project Material)

Profile of the Respondents

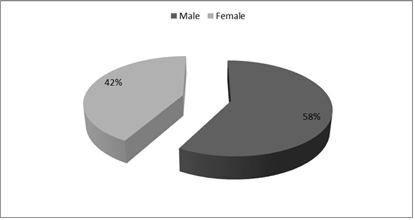

- Respondents Gender

The study sought to determine the gender disparity of the respondents. Figure 4.2 below displays the results of the analysis.

Figure 4.2: Gender of the respondents

From the findings, it was established that most of the respondents (58%) were male with a slightly lesser number of 42% of the respondents being female. The disparity calculated by 16% was not sufficient to create any bias in the study… (Scroll down for the link to get the Complete Chapter One to Five Project Material)

- Discussion

The study exhibited that there was a notable contrast in the financial performance of Julius Berger Plc because of changes in the proficiency of internal auditors, the efficiency of work of the internal auditors, top management support, and independence of the internal auditors.

This evidently displays that variations in the financial performance of the firms could be deemed to be from changes in these independent variables (proficiency of internal auditors, the standard of work of the internal auditors, top management support, and independence of the internal auditors). The study revealed that a strong affirmative connection existed between Julius Berger Plc and the proficiency of internal auditors, the grade of work of the internal auditors, top management support, and independence of the internal auditors.

From the independent variables measured (proficiency of internal auditors, level of work of the internal auditors, top management support, and independence of the internal auditors) revealed that a considerable 97.8% of the financial performance of firms at the NSE is shown by adjusted R2 (0.978).

This establishes that 97.8% of financial performance was the result of the independent variables whilst 2.2% of the financial performance of firms on the NSE was the result of arbitrary variations and factors not studied in this research… (Scroll down for the link to get the Complete Chapter One to Five Project Material)

SUMMARY, CONCLUSION, AND RECOMMENDATIONS

Summary

The internal audit function is important to the growth of firms as it provides essential services for the management of the firms. It is helpful in bringing a “methodical disciplined way to gauge and refine the control and governance procedures, the effectiveness of risk management” Institute of Internal Auditors.

It is a vital function and as evidenced by the increasing demand for this service in several organizations. The Internal Audit department is seen as an important factor when it comes to accounting systems being applied. The financial reports express the work and efficiency of an internal audit department and its efficiency will help in enhancing the efficiency of activities of the company… (Scroll down for the link to get the Complete Chapter One to Five Project Material)

- Conclusion

The study examined the effects of internal audit efficiency on the financial performance of Julius Berger Plc. The research concluded that the efficiency of the work of the internal audit sector has conspicuously and positively impacted the financial performance of organizations Julius Berger Plc.

The independent variables studied: professional proficiency of auditors, auditor’s independence, and efficiency of work of auditor’s and top management support showed that they all positively and significantly influence financial performance in a significant way… (Scroll down for the link to get the Complete Chapter One to Five Project Material)

- Recommendations

There is a need for firms to adopt effective internal processes and practices that address key internal auditing practices for the effectiveness of audit efficiency that cannot be overemphasized. Audit efficiency is mainly about the efficiency of people, their training, and the moral caliber. As such the Julius Berger Plc should consider the skills, personal qualities of audit personnel, and the tutelage given to audit staff as the important factors that determine auditor efficiency… (Scroll down for the link to get the Complete Chapter One to Five Project Material)

REFERENCES

Abbott, L. J., Parker, S., Peters, G. F., & Raghunandan, K. (2003). An empirical investigation of audit fees, non-audit fees, and audit committees.

Contemporary Accounting Research, 20(2), 215-234.

Al-Shammari, A. (2010). The role of the Audit Committees in Corporate Governance in Saudi Arabia. In Workshop paper. College of Business Administration-King Saud University (pp. 1-34)

Ashbaugh, H., & Warfield, T. D. (2003). Audits as a Corporate Governance Mechanism: Evidence from the German Market. Journal of International Accounting Research, 2, 1-21.

Audit efficiency (2005), Agency theory, and the role of audit, The Institute of Chartered Accountants in England and Wales (ICAEW), 1-14.

Barnes, L. (2008). Banking Sector Governance: Lessons from Hong Kong Listed Banks–A Three-Year Perspective.

Brown, L. D. and Caylor, M. L., Corporate Governance and Firm Performance.

Becker, C. L., DeFond, M. L., Jiambalvo, J., & Subramanyam, K. R. (1998). The effect of audit efficiency on earnings management. Contemporary Accounting Research, 15(1), 1-24.

Bett, C. C. (2014). The Relationship Between Effectiveness Of Internal Audit Function And Financial Performance Of Companies Listed.

Boone, J. P., Khurana, I. K., & Raman, K. K. (2010). Do the Big 4 and the second-tier firms provide audits of similar efficiency. Journal of Accounting and Public Policy, 29(4), 330-352. (Internal Audit Efficiency)(Internal Audit Efficiency)(Internal Audit Efficiency)(Internal Audit Efficiency)(Internal Audit Efficiency)(Internal Audit Efficiency)

Broye, G., & Weill, L. (2008). Does leverage influence auditor choice? A Cross- country Analysis. Applied Financial Economics, 18(9), 715-731. (Internal Audit Efficiency)(Internal Audit Efficiency)(Internal Audit Efficiency)(Internal Audit Efficiency)(Internal Audit Efficiency)(Internal Audit Efficiency)(Internal Audit Efficiency)

Becker, C. L., DeFond, M. L., Jiambalvo, J., & Subramanyam, K. R. (1998). The effect of audit efficiency on earnings management. Contemporary Accounting Research, 15(1), 1-24. (Internal Audit Efficiency)(Internal Audit Efficiency)(Internal Audit Efficiency)(Internal Audit Efficiency)(Internal Audit Efficiency)(Internal Audit Efficiency)

(Scroll down for the link to get the Complete Chapter One to Five Project Material)